direct vs indirect cash flow statement

Indirect cash flow method is the type of transactions used to produce a cash flow statement. The statement of cash flows under indirect method for Tax Consultation Inc.

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

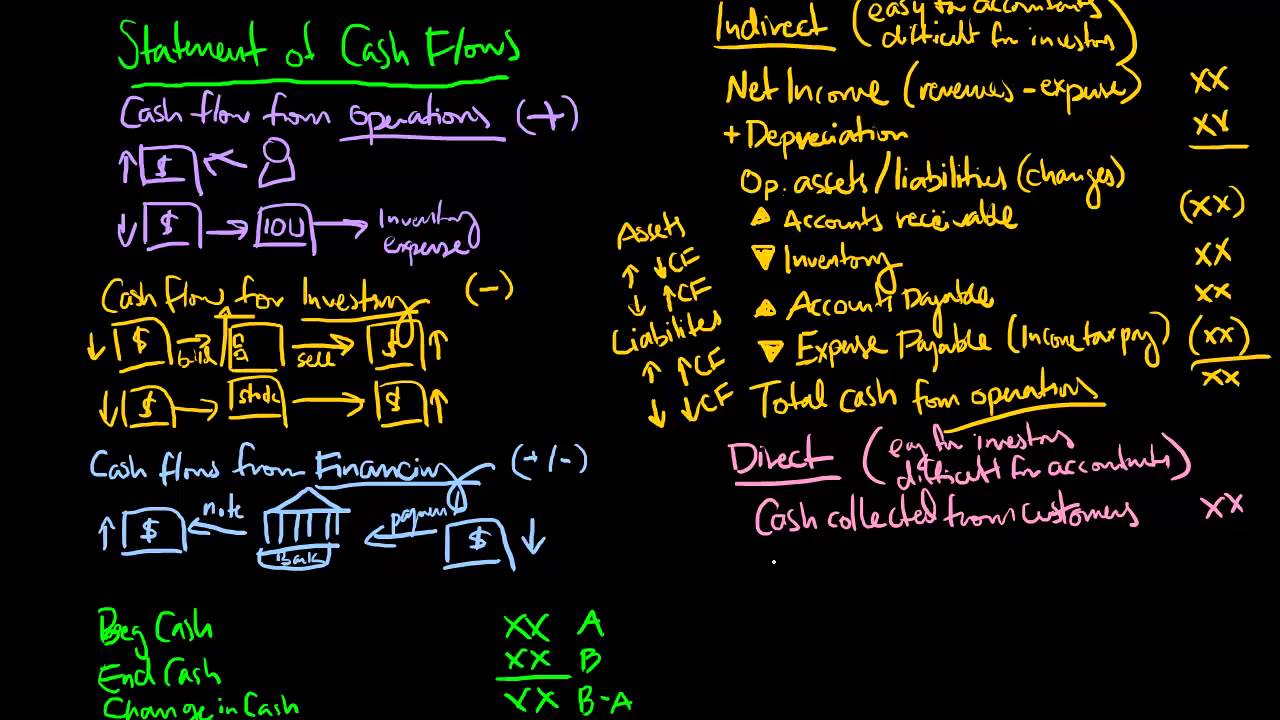

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses.

. Cash paid to employees. To do that you. Creating cash flow statements.

The statement starts with the operating activities section. Cash paid for other operating expenses. SINDHWAL ACADEMY 7011414005 WhatsApp 9899026399.

There are no presentation. We review both methods and which to choose. The direct method of cash-flow calculation is more straightforward and it shows all your major gross cash receipts and gross cash payments.

While under the indirect method the net income is adjusted for non-cash items and working capital changes to arrive at the net cash flows from operating activities. This video compares and contrasts the direct method for preparing the Statement of Cash Flows to the indirect method for preparing the Statement of Cash Flow. Whether direct or indirect cash flow method your cash flow statement may not always represent the information you want to share with your investors and other stakeholders.

The direct method of cash flow starts with the cash inflows and outflows of your business while the indirect cash flow method starts with your net income. The indirect method begins with your net income. The difference however only applies to the operating cash flow.

Indirect cash flow methods. A few examples of cash receipts and payments used in the direct method include receipts from customers tax and interest payments and payments to suppliers and employees. In the direct method of cash flow statement preparation actual receipts from customers and actual payments to suppliers service providers employees taxes etc.

Using a firms Balance Sheet Income Statement and an extract from the bank account you can easily construct the Cash Flow Statement. Some other related topics you might be interested to explore are Cash Flow Ratios. Here are the key differences between direct vs.

Obviously the direct method for calculating the net cash flow is not only less time consuming when comparing direct vs indirect cash flow methods but also more informative for analyzing cash flows since it makes it possible to get a more complete picture of their amount and composition allowing to determine not only the net cash flows by type of activity but also. With a regular cash flow statement prepared using the direct method we take the following amounts from our accounting records and input them directly in the first section of the statement. While both are ways of calculating your net cash flow from operating activities the main distinction is the starting point and types of calculations each uses.

Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. The direct method only. Alternatively the direct method begins with the cash amounts received and paid out by your business.

Direct vs Indirect Cash Flow Statement. Still it is one of the most crucial statements to financial reporting. Cash paid to suppliers.

The indirect method backs into cash flow by adjusting net profit or net income with changes applied from your non-cash transactions. The indirect method uses net income as the base and converts the income into the cash flow through the use of adjustments. Nor does a direct method cash flow statement reflect obligations in the future such as balloon paymentsAn indirect method cash flow statement on the other hand reflect future payments and income and thus are more closely tied to the balance sheet and income statement.

A cash flow statement records when the money is physically received or paid rather than an income statement that records income and expenses on an accrual basis. Either the direct or indirect method may be used to report net cash flow from operating activates. Cash flow statement-Indirect Method For.

One of the key differences between direct cash flow vs. Cash receipts from customers. The Direct method discloses major classes of gross cash receipts and cash payments while the Indirect method focuses on net income and non-cash transactions.

Comparing the Direct and Indirect Cash Flow Methods. With a regular cash flow statement prepared using the direct method we take the following amounts from our accounting records and input them directly in the first section of the statement. We are now ready to prepare the statement of cash flows.

The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows. The investing and financing sections present the same way whether you use the statement of cash flows direct method or indirect method. Under the direct method the statement of cash flows reports net cash flow from operating activities as major classes of operating cash receipts eg cash collected from customers and cash received from interest and dividends and cash disbursements eg cash paid to suppliers for goods to employees for services to creditors for interest and to government authorities for.

Cash receipts from customers. The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. With the direct method of cash flow you count only the money that actually leaves or enters your business during the designated reporting period.

The main difference between the direct and indirect cash flow statement is that in direct method the operating activities generally report cash payments and cash receipts happening across the business whereas for the indirect method of cash flow statement asset changes and liabilities changes are adjusted to the net income to derive cash flow from the. Direct vs Indirect Cash Flow Statement.

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Statement Cash Flow Learn Accounting

Statement Of Cash Flows Significant Non Cash Activities Bookkeeping Business Accounting Classes Cash Flow Statement

Cash Flow From Investing Activities Cash Flow Statement Cash Flow Deferred Tax

Myeducator Accounting Education Accounting Classes Accounting Student

Cash Flow From Operating Activities Learn Accounting Accounting Education Positive Cash Flow

What Is Cash Flow And How Can You Effectively Manage It Bench Accounting Cash Flow Cash Flow Statement Small Business Finance

Check It Out Cash Flow Statement Positive Cash Flow Cash Flow

Statement Of Cash Flows Indirect Finance Saving Cpa Exam Cash Flow

Two Methods Are Available To Prepare A Statement Of Cash Flows The Indirect And Direct Methods The Financial Acco In 2021 Cash Flow Cash Flow Statement Direct Method

Cash Flow Statement Template Download Excel Sheet Cash Flow Statement Cash Flow Statement Template

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Excel Spreadsheets Templates Spreadsheet Template

A Cash Flow Statement Template Is A Financial Document That Provides Valuable Information About A Com Cash Flow Statement Bookkeeping Business Learn Accounting

The Essential Guide To Direct And Indirect Cash Flow Cash Flow Cash Flow Statement Flow

Statement Of Cash Flows Explained Cash Flow Statement Cash Flow Accounting Classes

Debit And Credit Cheat Sheet Making Of Cash Flow Statement With Both Direct And Indirect Methods Bookkeeping Business Accounting Accounting Classes

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Bookkeeping Business Cash Flow

Statement Of Cash Flows Indirect Method Format Example

Cash Flow Statement Format Indirect Method Cash Flow Statement Cash Flow Positive Cash Flow

Methods For Preparing The Statement Of Cash Flows Cash Flow Statement Cash Flow Accounting Principles